For reasons I may dilvuge at a later date, I didn’t have time to do a blog yesterday, and today I have just a few minutes before going out to complete the BBC Lifeline Appeal film on behalf of Leukaemia and Lymphoma Research; then off to Grassington in Yorkshire for their annual festival where I will talk books, politics and meet up with some of the Calendar Girls, the nearest LLR have to pin-ups.

Sorry for the long ‘intro’ (at journalism school we were urged to keep it under 30 words, preferably 20) but it shows I am rushing I guess.

Time simply to say that in various snatches of car radio news yesterday, I was glad to hear Alistair Darling refuse to lie down and die in the face of a ConDem spin operation that, as one of the right-wing bloggers says this morning, would have made me in my heyday blush.

Despite the spin, the reality is that the Alan Budd report is not quite what Dr Osborne ordered. Yes, it says that growth is likely to be lower than forecast. It also says borrowing will be lower, which tends to blow a fairly big hole in the Osborne-Cameron-Clegg argument mounted in recent days.

And while the spin went for a ‘game, set and match’ to set the tone of the debate for years to come, by the end of the day, it was more like a tie-break situation. And if, as many now seem to fear, the rush to cut helps usher in a double dip recession, then the Tories’ ‘everything is Labour’s fault’ strategy (so much for taking politics out of the economy) will look a bit lame.

Must rush.

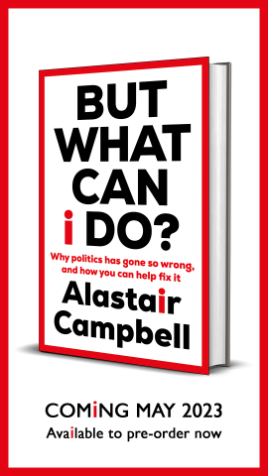

*** Buy Prelude to Power here at Amazon.

*** Buy The Blair Years and raise cash for Labour http://www.alastaircampbell.org/bookshop.php.

I hope you’re right Alastair, it feels to me that the Tories have been entirely successful in framing the debate exactly as they want to.

This all fits into a strategy for re-election of ‘We know we’ve made a mess of everything but it’s not our fault, we had no choice as we inherited such a mess from Labour…”

A few things I’ve noted over the past few weeks;

1. The subtle but deliberate theme that the ‘massive’ deficit is ‘Labour’s fault,’ ‘Labour’s mess’ etc. Shifting the focus from the fact that the deficit is so big because of the recession. Oh and missing the fact that as a proportion of GDP, neither the debt nor the deficit are massive in historical terms.

2. For the more thoughtful voters the argument about ‘structural deficit’ slips in.

3. The Office for Budget Responsibility keeps being referred to as ‘independent.’ Quite how an organisation set up by the Conservative party prior to the election and then transferred into a quango post-election which is led by George Osborne’s hand picked head and staffed by the same people who used to do predictions for the treasury can be independent is beyond me.

My great fear is that this message seems to be carried unchallenged by all the media.

AFZ

Thanks Alistair,

I did wonder when we would hear your take on the whole charade of ‘new politics’.

Simply put Osborne had already taken a position and fiddled (interpreted) the forecastes to suit his it. I did think he was a bit pompus and overconfident yesterday, when in fact there is no reason to be.

The Highlights seem to be:

1)The deficit is much more less than was though;

2)The growth was adjusted slightly; and

3)According to the forcastes, the Labour government would have halved the deficit by the end of the parliamnt.

Whatever, the past government’s faults, it remains a sheer fabrication and a lie of the Condems that the overall fiscal situation is worse than they thought. They are simply looking for cover to fufil their idelogical lusts for cuts and cuts. I feel sorry for the Liberals who are being pulled along in that direction.

Kudos to Alistair Darling for standing up to them.

By the way did you see Danny Alexander on Channel 4 News, looking like a naughty school boy whoose fingers had been caught in the tiller, he does inspire great confident, surely now is the time for a novice.

I make one bold prediction, that after the Labour leadership is concluded, these Condems will not stand up to scrutiny.

Alastair

This is really driving me mad now. WHY IS NO ONE OUT THERE GETTING THIS MESSAGE HOME? Tories being allowed to continue with the myth that Labout has destroyed the economy and no one is challenging them, or at least if they are, it is not being reported.

J

“…as many now seem to fear, the rush to cut helps usher in a double dip recession….”

The real risk, Al, is that when the accrued defecit hits £1,400 billion, as forecast, under Labour we may have been paying annual interest at 10%, because the markets could not trust you. Why can’t you see that?

I agree with many of the comments and I wish someone would fight back against these ‘fault/blaming’ comments from the ConDems. Mr and Mr Clegoron with their sidekicks Osborne & Co never answer questions on PMQT, they just keep blaming Labour.

Lib Dems look uncomfortable, especially Clegg, although he is enjoying his (so called) power, he is just sitting there looking exactly what he is…..DC’s puppet.

DC and his gang have just used the LibDems to get into Downing Street, that’s all DC really wanted and Clegg was fool enough to fall for it and convince others of it too so he could have the position he has now.

What a sham this whole coalition government is.

TORIES LIED

LIBDEMS USED

LABOUR TOLD US BUT WE DIDN’T LISTEN.

Now look what we’ve got.

A scaremongering government who thinks the British People are stupid enough not to realise that giving them this chance will ruin this country.

Let’s hope we can all put this right very soon.

In his expectation management speech Dave the PR man said that without cuts Britain faced a debt interest bill of £70bn. But it now seems that even with bigger cuts than the Con-Lib government is proposing Britain will still have £70bn interest rate bill by 2014! The truth appears to be that debt interest is largely related to the total size of national debt.

According to IFS only in 2030 will the national debt be back to 40% of GDP level before the crisis.

Good cop Nick Clegg said that things will not be as harsh this time as in the 1980s. But under Margaret Thatcher public spending increased by 1.7% a year!

The deficit must come down. Structural deficit (or at least much of it) must be eliminated during this Parliament. But how and when is the question. Is the 80/20 ratio between cuts and taxes right?

Early cuts can risk growth. This could lead to recession or even a prolonged depression. Nobel winner Paul Krugman is against early cuts. The Lib Dems have made U-turn on them citing eurozone sovereign debt problems. But Britain is not Greece. Britain has valuable assets and less debt. Britain can borrow at low cost. And not much of debt is owed to foreigners.

Britain´s debt compared to GDP is smaller than that of France, Germany, Italy, Japan or the US.

According to Institute for Fiscal Studies deficit was caused by increased spending because of unemployment benefits, financial sector bail outs and also because of falling tax receipts.

According to Jeffrey Sachs Britain and others overborrowed for a decade. Average budget deficit between 2003-07 was £32bn. But cutting government spending when the economy was growing would have caused inflation.

Yet Britain was ill-prepaired for the financial crisis of 2007-08. And Gordon Brown sold national gold stocks at wrong time. Nevertheless, Britain was better placed to face the global economic crisis, which started because the Fed caused housing bubble by keeping interest rates too low, than many other countries. And the Keynesian response was the right one.

There appears to be doubt whether the £6bn cuts can be made by next April and whether the Con-Lib government can protect frontline services. There is also the question of £310bn of official support to the banks due to expire over the next couple of years meaning a looming funding gap.

We are all in this together – but some are in it more than others. As usual, the “undeserving poor” will suffer most.

TUC, Compass etc. have demonstrated that there are alternatives to cuts. Make, for example, banker´s bonus windfall tax permanent. 0.05% financial transaction tax on instant sterling transfers between UK financial institutions would bring in £38bn a year!

Britain in also Unite´s kingdom. There will be union resistance to the cuts. £60bn annual cuts will be politically and practically difficult to implement.

And the landslide of planned cuts will cause huge inequality. Public service cuts will fall disproportionately to the poorest people. Alternative to cuts is to raise income taxes and VAT.

David Cameron should realize that public and private sector are mutually dependent. Cutting public sector does not automatically mean flourishing private sector. Private sector rely also on public sector.

R Burnell, you’re wrong.

But don’t take my word for it. Joseph Stiglitz writing in the Independent this week:

“Appeasing the markets is like trying to reason with a crazy man; after Spain announced its cutbacks, the ratings agencies downgraded its debt because of lower growth prospects as a result of those cuts! You can’t win with markets. Better to follow the right policy: supporting growth through higher spending on public investment and infrastructure, which will help the economy grow faster in the long term.”

This is the massive danger of these irresponsible idiots.

As time goes on, Alastair Darling is looking more and more impressive.

Three interesting contributions from Labour’s media monitoring report of this morning, which I have caught up with since posting a quick blog this morning. They show that despite the bulk of the media swallowing the Tory line at the moment, on this as on pretty much everything, they are not having it all their own way. The first is by a Nobel prize winner, the second by one of the few commentators who gets both economics and politics, and the third – whilst from a right-winger – makes clear the right wing view that even though the Budd report does not validate Tory claims for the economy, they should get on and cut for ideological reasons anyway (which they will)

‘Fiscal conservatism may be good for one nation, but threatens collective disaster’ (Indy p7 comment) – Nobel prize winner Prof Joseph Stiglitz says it is unambiguously clear that if European economies decide to cut their borrowing, slash spending & raise taxes growth will be lower than it otherwise wld have been. There is a risk that the European economy will go into a “double-dip” recession. The fiscal conservatives do seem to be gaining ground, which adds to the risk of a global weakening of all the advanced industrial economies. Stiglitz says what is especially dangerous in Europe right now are the cuts in the wages of public sector workers. What will not move down is the value of the debts incurred by households in countries such as Ireland & Spain. So, with a lower salary & the same mortgage & consumer debts, many families will default on their debts. That cld place much more stress on the banking system, & make the banks even more cautious & unwilling to extend credit, which wld add another twist to the downward spiral. Stiglitz says the UK shld set itself up as Europe’s growth economy. A debt-to-GDP ratio of under 75%, which is where it will peak, is manageable. In that context, the case for more cuts is weak. Appeasing the markets is like trying to reason with a crazy man. Better to follow the right policy: supporting growth through higher spending on public investment & infrastructure, which will help the economy grow faster in the long term.

‘The tensions behind Cameron’s puff and PR’ (FT op-ed) – Philip Stephens says that so far Cameron’s government has offered mostly puff & public relations. Policymakers overseas find it curious to say the least that the government has been so keen to pronounce Britain bankrupt. Comparisons with Greece are unwise in the midst of a sovereign debt crisis, & some of those attending a recent meeting of Group of 20 finance ministers in South Korea wondered whether Osborne was not inviting speculators to make Britain a target. The promise to get rid of most of the budget deficit within the lifetime of a parliament is an insufficient condition for a return to sustained prosperity. It is also not self-evident that accelerated efforts to restore the health of the public finances will cure rather than kill the patient. Cameron has suggested that the private sector will march unbidden into the economic space left by a shrinking state, but there has been no explanation as to where the demand will come from. What is required of Osborne’s Budget is a medium-term deficit-reduction plan credible enough to win the confidence of markets along with enough short-term fiscal flexibility to allow the economy to keep growing. Spending cuts & tax increases to bring down the deficit over the medium term will bring political unpopularity enough. A first Budget later judged to have driven the economy back into recession wld wreck the coalition’s claim to economic competence. This potential collision between growth and fiscal policy is mirrored by a second: between austerity & Cameron’s cherished localism. Almost everything Cameron wants – including preserving village schools & local hospitals – runs into the same Treasury objection. Localism dilutes accountability & is too expensive. For his part Clegg persists in asserting that spending cuts will be “progressive”. Treasury assessments of the impact of spending cuts across the income scale have long indicated otherwise – poorer people suffer most. Puff & PR seem unlikely to change that (FT)

‘This is Osborne’s moment to be radical’ (Tele op-ed) – Nelson says the Chancellor is a week away from an emergency Budget & had hoped to advance a clear narrative: that things are much worse than thought, so the cuts will have to be deeper than he had admitted during the election campaign. But, embarrassingly, the economy is not playing along. Things just keep getting better. Sir Alan said yesterday that Darling was being too pessimistic: on almost every measure, the public finances look like being in better shape. Unemployment will be almost 200,000 lower than had been feared. Economic growth will not be quite as strong but the tax revenues – which are far more important – will come in much more strongly than Darling gloomily forecast. Something is going badly right. Manufacturing is bouncing back, demand for UK debt remains strong – keeping bond yields low. Banks are lending & money supply is increasing. Just as the economy sprang a volley of nasty surprises as we entered the crash, it’s yielding pleasant surprises now. Osborne’s election goal – to abolish ‘the bulk’ of the structural deficit by 2014 – wld have been easily achieved had Darling remained in place. No more taxes need to be raised, or budgets cut, to honour this Tory manifesto pledge. Osborne will have to change tactics. He cannot credibly play the worse-than-we-thought card if Sir Alan’s team – on whom he has bestowed Delphic authority – disagrees. Instead, he will have to focus on something from which he shied away in opposition: the moral case for cuts; to argue, on Budget day, that even if Britain cld keep on borrowing it wld be reckless & wrong to do so. Nelson says Osborne shld not portray himself as a hostage to the bond markets. He can argue that he will cut more than Labour wld have because he wishes to restore the power balance between state & society. A true liberal believes that people spend their own money more wisely & effectively than government can do on their behalf. To rely on deficit spending is to saddle the next generation with billions upon billions in debt. With Harman responding to his budget, Osborne will never have a better time to be radical. That is why he shld take yesterday’s irritating good news on the chin – & cut, come what may.

AC – excellent commentary again. (Although I am intrigued by the repeated ‘shid’ – is this a commentary on the LibDems language skills again or code for the defecation of their support for the Tories ?)

Interesting that OBR is using ‘central’ forecasts rather than the Treasury’s ‘cautious’ practice. This makes them inherently more risky in political terms since nobody in the media is publishing the confidence spread that is buried in the detail. If the OBR had been subject to scrutiny prior to its first forecast we might have understood better how it was going to work. By the way, I have not seen any reporting of how much the April to June moves to austerity in Eurozone & UK have themselves influenced the forecast. It must have had some effect (perhaps .5 of a percentage point in growth ??.

Lastly, please, please, please can all the Famous Five bidding for the LP leadership carve up between them the anti-cuts arguments and focus on supporting HH and AD up to the conclusion of the Budget debate and get on the broadcast media as much as possible to concentrate on that message. Remember it’s the economy stupid. I will be urging David Miliband at his Sheffield meeting to do just that.

However

The Coalition is still in it’s infancy or honeymoon period though Vince Cable is suddenly very quiet. He couldn’t wait to get on TV with solutions when in opposition.

‘Bit disturbed to hear that A Darling kept figures from GB until it was to late to use them – what the hell was going on there?

GB/AD WERE RIGHT, AND DC/GO WERE WRONG.

The great thing about the Labour leadership running over so many weeks is that the old team are still in their familiar positions, albeit with a shadow brief. So when AD stands up to debate the economy people take notice of what he is saying because he, literally, has had more experience that his counterpart.

I can’t be the only person who thinks that Alistair Darling still displays a gravitas that’s head and shoulders above the increasingly nasal George Osbourne and his new (seriously, what were they thinking?!) sidekick Danny Alexander. Alistair Darling’s continued presence and methodical deconstruction of the facts will act as a useful block to the coalition govt’s attempt to tarnish Labour with our economic woes.

*** Incidentally, anybody who enters front line politics using the name ‘Danny’ should be immediately relegated to the back-benches. I mean, come on, he’s No. 2 in The Treasury!

*** I can’t be the only one is beginning to relish how this government is constantly being referred to as ‘The Coalition’. Just think about it for a moment. Not ‘Tory’. Not ‘Conservative’. But ‘Coalition’. It means the Tory brand has still yet to solidify in the minds of the electorate and is unlikely to do so. ‘Coalition’ = ‘gimmick’ and the public soon tire of those.

This government is about to burst at the seams…their only trick is the blame game….and they were going to transform British Politics……it’s just not going to happen is it?

All very interesting but i would like to see Julies point answered. WHY IS NO ONE CHALLENGING THE TORIES? Labour need to know that even if they do not think it neccesary those of us supporters do.

This is off topic but I believe in praise where praise is due. Today is the day when the families of the victims of Bloody Sunday finally got some justice for their loved ones.I thought David Cameron did a fine job today and he wasted no time in offering an apology for those terrible wrongs. I was living in Northern Ireland and the time of these killings and well remember the horror and subsequent disturbances on the streets. Some awful atrocities have been committed in NI over the years of the troubles and no side comes out looking good. I do not see any point in attempting to prosecute the soldiers involved after such a long time, but it is good to see the truth out there at last and the families may now reach some form of closure.In all this after election squabbling about who was right and who was wrong, sometimes it does you good to step back and appreciate all the things that are good in life. To hold your families close in the knowledge that somewhere in the world families are suffering the pain of war and hate. We sometimes just need to be thankful.

The ConDem spin that the media has lazily followed omits one major event between the budget and this report – the general election and the clear change in government policy. Far from Alistair Darling getting it wrong surely the Tory commitment to slashing public spending at the earliest opportunity is what has changed growth predictions. Shame that George’s new Quango has missed this obvious link.

Previous posters are right, Labour now need a few attack dogs to respond to all the Con-Dem lies and spin. Now the 2 coalition parties have had their first “political Cabinet” meeting, it’ clear from now on they’ll co-ordinate tactics against Labour – Clegg has done little but criticise Labour since becoming DPM.

Interesting how the BBC covered the economic story yesterday. All day the gospel according to Gideon was trotted out almost without challenge, although Alistair Darling was allowed to speak his mind on the Daily Politics. There was very little difference in the line taken by all mainstream news reports – in essence that, according to Alan Budd, Alistair Darling had got it wrong. However, Newsnight turned this analysis on its head, interpreting the Budd report as vindicating the predictions made by the Labour chancellor.

It seems that the the reports aimed at the majority population carried the simplistic pro Tory line, whereas the few politically aware viewers who might watch Newsnight could be trusted with a more honest analysis.

Is this what the BBC means by balanced reporting?

Labour has to attack this nonsense that the Brown government ruined the country. Everyone on the left knows that ConDems are using this spin to justify savaging cuts to the public sector and the Tories had this in mind all along. At least Alistair Darling is speaking up for us – can the rest of Labour frontline do the same please? We need some back up out here.

I predicted (www.minghella.com/shock-report-reveals-truth-on-economy/) that the spin would continue into the following day’s headlines. I was wrong.

Janette has it right, though I read it as more accidental than malicious. The media bought the spin in its initial coverage, but then quickly realised the document exonerated Labour, so they quietly dropped it, and by the time we got to Newsnight, the reverse (and correct) line was being presented. The OBR showed Labour’s numbers were pretty much bang-on. It revealed Osborne’s fist-waving in Parliament – “never again will a Government be allowed to fiddle the figures” – for what it was: shameless politics. Frankly, that display merited an apology.

So galling then, to hear Cameron v Harman yesterday saying Labour “should start with an apology”. Unbelievable. The “Labour mess” line is as dangerous as it is disgraceful, and may very well put the wind up the very people it is designed to please – the private sector. But that is a whole ‘nother argument.

The point is that the tone of this government is set. And boy, is it ugly.

The only good thing about it, Alastair, is that it leaves room for Labour to respond to the public’s desire for more decent politics – something which a few weeks ago, in virtue of incumbency, Labour could not achieve.

If I had been advising the ConDems, I’d have encouraged them to go for the lofty/new era/holier-than-thou positioning for longer. That would have made old-fashioned adversarial opposition much harder. But they just couldn’t help themselves.

It does mean Labour need a leader sooner than they are going to get one. The punches are only coming one way.

But it also means the ‘New Politics’ high ground is now irrevocably lost to the Coalition.

Whereas Labour, died and then reborn, could yet mysteriously save.

sorry wrong link. Correct one: http://www.minghella.com/the-cuts-bandwagon/